Section 5

Section 5 of the Uniform Residential Loan Application (URLA), which is focused on Declarations about the borrower's financial history and intentions regarding the property.

Here's a breakdown of the various parts of Section 5:

5a. About this Property and Your Money for this Loan This subsection inquires about the borrower's plans for the property and any additional financial details that relate to the transaction. Questions include:

- Whether the borrower will occupy the property as their primary residence.

- If the borrower has had an ownership interest in another property in the last three years, and if so, what type of property and how the title was held.

- If there's a family relationship or business affiliation with the seller of the property.

- If the borrower is borrowing any money for the real estate transaction or obtaining money from another party that hasn't been disclosed on the loan application.

5b. About Your Finances This subsection asks questions related to the borrower's financial obligations and history, including:

- If the borrower is a co-signer or guarantor on any debt not disclosed on the application.

- Whether there are any outstanding judgments against the borrower.

- If the borrower is currently delinquent or in default on a Federal debt.

- If the borrower is a party to a lawsuit with potential personal financial liability.

- If the borrower has conveyed title to any property in lieu of foreclosure in the past 7 years.

- Whether the borrower has completed a pre-foreclosure sale or short sale where the property was sold for less than the outstanding mortgage balance.

- If the borrower had property foreclosed upon or declared bankruptcy within the past 7 years, and if so, the type of bankruptcy.

The purpose of Section 5 is to gather comprehensive information about the borrower's financial situation and any factors that might impact their ability to repay the loan. This includes understanding their past financial difficulties, current obligations, and any potential conflicts of interest in the property transaction. All of this information helps the lender assess the risk associated with lending to the borrower and to make an informed decision about loan approval.

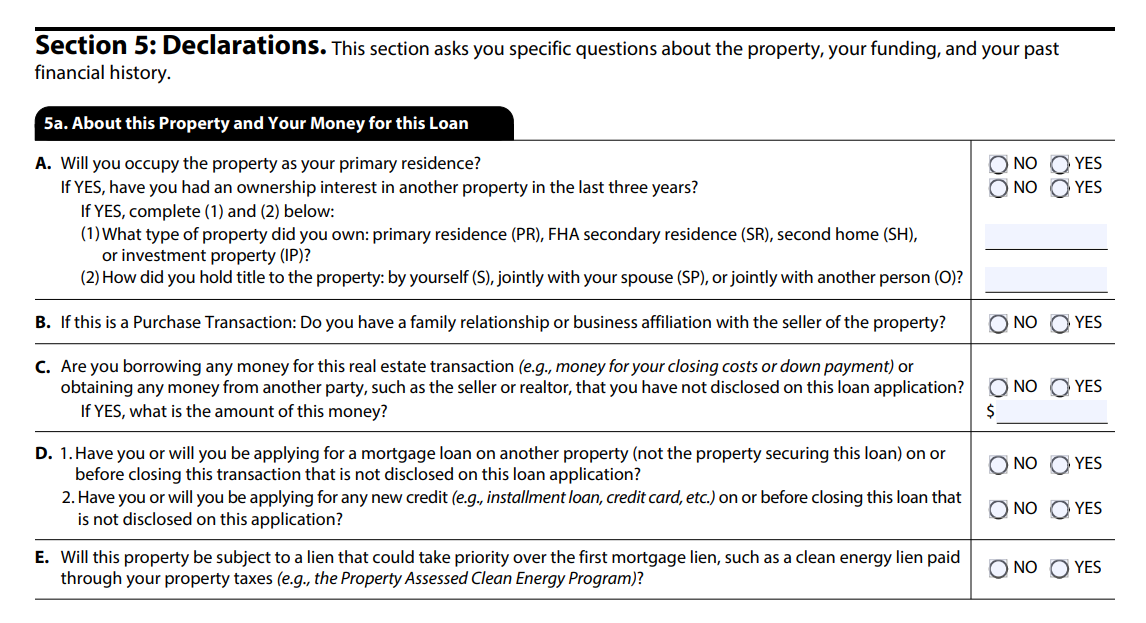

Section 5a: About this Property and Your Money for this Loan

A. Will you occupy the property as your primary residence?

- The applicant must indicate whether they will live in the property as their main home.

If YES, have you had an ownership interest in another property in the last three years?

- If the applicant will occupy the property as their primary residence, they must disclose if they have owned another property within the last three years.

If YES, complete (1) and (2) below: (1) What type of property did you own: primary residence (PR), FHA secondary residence (SR), second home (SH), or investment property (IP)?

- The applicant specifies the type of property previously owned.

(2) How did you hold title to the property: by yourself (S), jointly with your spouse (SP), or jointly with another person (O)?

- The applicant details how the title to the previously owned property was held.

B. If this is a Purchase Transaction: Do you have a family relationship or business affiliation with the seller of the property?

- The applicant must disclose any family or business connections with the seller.

C. Are you borrowing any money for this real estate transaction (e.g., money for your closing costs or down payment) or obtaining any money from another party, such as the seller or realtor, that you have not disclosed on this loan application?

- The applicant must reveal if there are any undisclosed loans or financial contributions involved in the transaction.

If YES, what is the amount of this money?

- If there are undisclosed funds, the applicant must provide the amount.

D. 1. Have you or will you be applying for a mortgage loan on another property (not the property securing this loan) on or before closing this transaction that is not disclosed on this loan application? 2. Have you or will you be applying for any new credit (e.g., installment loan, credit card, etc.) on or before closing this loan that is not disclosed on this application?

- These questions ask the applicant to disclose any other mortgage applications or new credit applications that have not been previously mentioned.

E. Will this property be subject to a lien that could take priority over the first mortgage lien, such as a clean energy lien paid through your property taxes (e.g., the Property Assessed Clean Energy Program)?

- The applicant must state if there will be any liens on the property that could supersede the first mortgage lien.

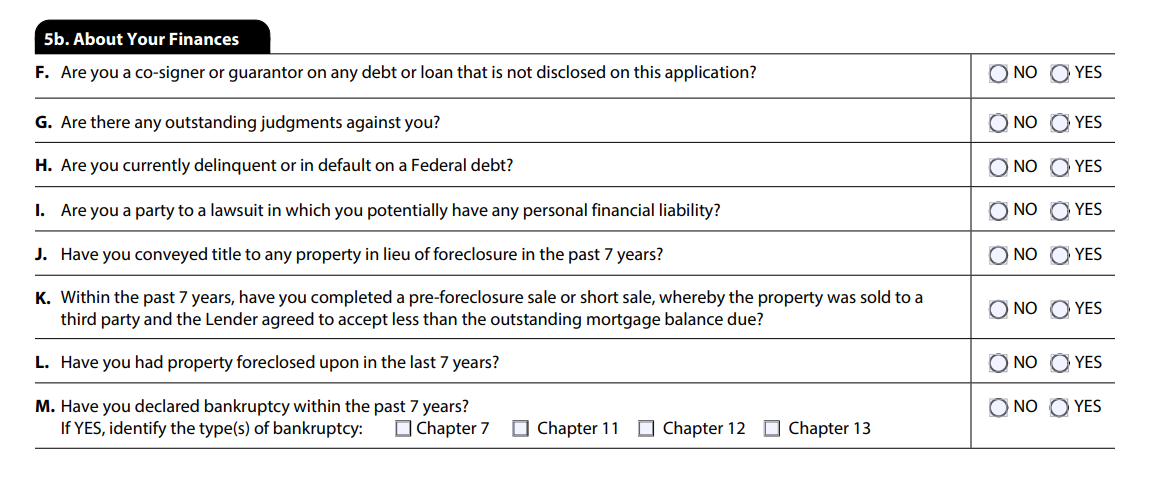

Section 5b: About Your Finances

F. Are you a co-signer or guarantor on any debt or loan that is not disclosed on this application?

- The applicant must disclose if they are responsible for any debt not mentioned in the application.

G. Are there any outstanding judgments against you?

- The applicant must reveal if there are any legal judgments for debt against them.

H. Are you currently delinquent or in default on a Federal debt?

- The applicant must state if they are late or in default on any debt owed to the federal government.

I. Are you a party to a lawsuit in which you potentially have any personal financial liability?

- The applicant must disclose if they are involved in any lawsuits with potential financial consequences.

J. Have you conveyed title to any property in lieu of foreclosure in the past 7 years?

- The applicant must indicate if they have transferred the title of a property to avoid foreclosure within the last seven years.

K. Within the past 7 years, have you completed a pre-foreclosure sale or short sale, whereby the property was sold to a third party and the Lender agreed to accept less than the outstanding mortgage balance due?

- The applicant must disclose if they have been involved in a short sale or similar transaction in the past seven years.

L. Have you had property foreclosed upon in the last 7 years?

- The applicant must state if they have had a property foreclosed upon within the last seven years.

M. Have you declared bankruptcy within the past 7 years?

- The applicant must disclose if they have filed for bankruptcy in the past seven years.

If YES, identify the type(s) of bankruptcy:

- If the applicant has declared bankruptcy, they must specify the type(s), such as Chapter 7, Chapter 11, Chapter 12, or Chapter 13.

Each of these questions is designed to provide the lender with a clear picture of the applicant's financial situation, history, and any potential risks that may affect their ability to repay the loan. It's important for applicants to answer these questions truthfully and accurately.