Section 4a,b,c

Section 4 of the Uniform Residential Loan Application (URLA) delves into the specifics of the loan and property the applicant is seeking to finance. The section is divided into several subsections, each addressing different aspects of the loan and property details. Here is an in-depth look at each subsection:

There are also questions about the mixed-use of the property, such as whether the applicant will set aside space within the property to operate their own business, and if the property is a manufactured home.

4b. Other New Mortgage Loans on the Property You are Buying or Refinancing Applicants must disclose if there are any other new mortgage loans on the property that is being purchased or refinanced. This includes providing details such as the loan amount or credit limit, creditor name, lien type (first lien or subordinate lien), monthly payment, and the amount to be drawn if applicable.

4c. Rental Income on the Property You Want to Purchase This subsection is specifically for purchase transactions and requires the applicant to provide information as directed by the lender regarding any rental income from the property being purchased.

Each of these subsections plays a critical role in the lender's evaluation process. The information helps the lender understand the purpose of the loan, the type of property being secured, the applicant's plans for occupancy, and any additional financial obligations related to the property that could impact the applicant's financial situation and the loan decision.

Section 4d

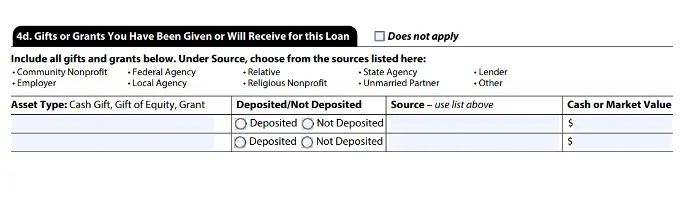

Section 4d of the Uniform Residential Loan Application (URLA) addresses Gifts or Grants that the applicant has been given or will receive to assist with the loan. It's important for lenders to know about any gifts or grants because they can affect the applicant's financial situation and the underwriting of the loan. Here's what this section covers:

4d. Gifts or Grants You Have Been Given or Will Receive for this Loan Applicants are required to disclose any gifts or grants they have received or expect to receive that are related to the loan. This could include a cash gift, a gift of equity, or a grant. The source of these gifts or grants must be indicated, and the list of possible sources includes entities like community nonprofits, federal agencies, relatives, state agencies, employers, local agencies, religious nonprofits, unmarried partners, and others.

The applicant must also specify whether the gift or grant has been deposited or not, and provide the cash or market value of the gift or grant. This information is crucial because it helps the lender assess the applicant's ability to make a down payment and cover closing costs, which may in turn influence the loan-to-value ratio and the need for mortgage insurance.

Overall, Section 4d is designed to ensure full transparency regarding additional financial support the borrower may have, which can impact the terms and approval of the mortgage loan.