Section 3a

Section 3a of the loan application is where you list any properties you currently own. If you're refinancing your house, you'd put that one first. You need to give the address, what kind of property it is (like a single-family home or a duplex), and whether you live there, rent it out, or use it as a vacation spot.

You also have to share the financial details: your monthly mortgage payment, how much you still owe on the place (the unpaid balance), and any income you make from it, like rent from tenants if you're a landlord. And don't forget to include the costs for things like insurance, property taxes, and homeowner's association fees if they're not part of your mortgage payment.

Basically, this section helps the lender understand what kind of real estate you have, how much it's costing you, or how much money it might be bringing in each month. It's a key part of figuring out if you can afford the loan you're asking for.

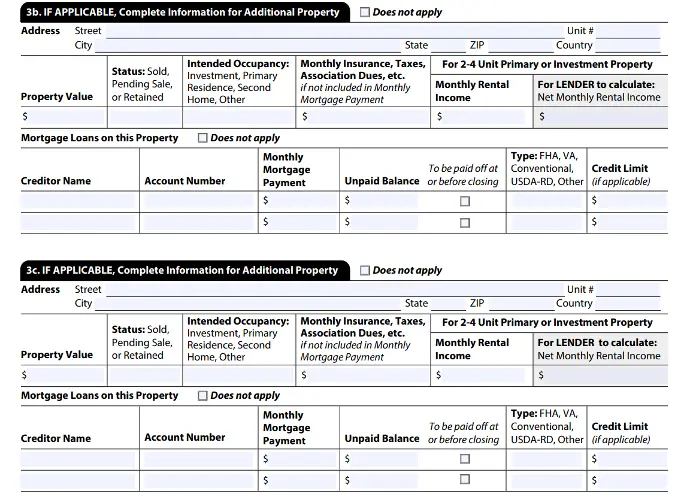

Section 3a of the Uniform Residential Loan Application requires the disclosure of all real estate presently owned by the applicant. If the application pertains to a refinancing scenario, the property subject to refinancing should be listed first and foremost.

The applicant must furnish the full address of each property, including street, unit number, city, state, ZIP code, and country. Additionally, the intended occupancy of each property must be indicated, specifying whether it is a primary residence, investment property, second home, or another category.

Financial specifics are also mandated, encompassing the monthly mortgage payment, any association dues, insurance, and tax expenses not included in the mortgage payment, as well as the total mortgage loans on the property, characterized by type (e.g., FHA, VA, Conventional, USDA-RD, etc.). If applicable, the monthly rental income and net monthly rental income are to be reported.

This section is instrumental in providing the lender with a comprehensive understanding of the applicant's real estate assets, liabilities, and income generated from such properties, which is crucial for the assessment of the applicant's financial capability and loan eligibility.

3b and 3c

Rinse and Repete