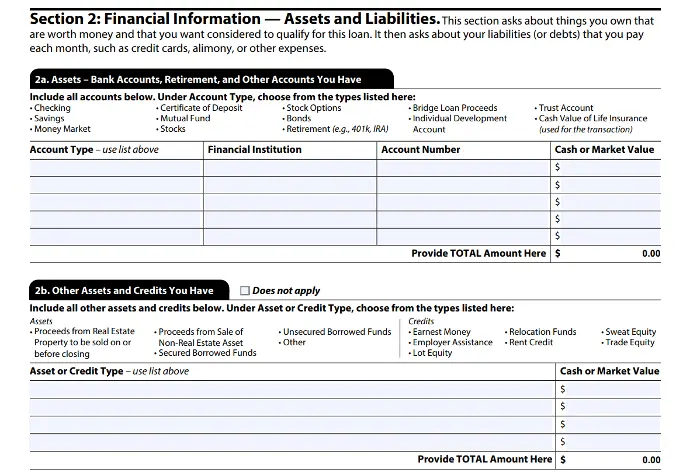

Section 2a and 2b

Moving on to assets in this section. Again, being as complete as possible is best as it will assist the speed of review

Sections 2a and 2b of the Uniform Residential Loan Application (URLA) are designated for detailing the borrower's assets, which are important for the lender to assess the borrower's financial strength and capacity to repay the loan.

Section 2a is specifically for documenting more liquid and established assets, which are typically easily verifiable through financial statements or account balances. This includes funds held in bank accounts like checking and savings accounts, as well as investments such as retirement accounts, mutual funds, stocks, bonds, and the cash value of life insurance policies. The applicant is required to provide the account type, financial institution, account number, and the current cash or market value for each asset listed.

On the other hand, Section 2b addresses assets that may not be as immediately liquid or may be pending acquisition. This section captures assets that are expected to be converted into cash or used to facilitate the transaction but are not currently reflected in a bank statement or similar financial document. Examples include earnest money deposits, proceeds from the sale of property that has not yet closed, sweat equity, or other forms of assets and credits that are part of the transaction but are not yet realized. The applicant should list the type of asset or credit, along with its cash or market value, even if the value is anticipated and not currently available in a liquid form.

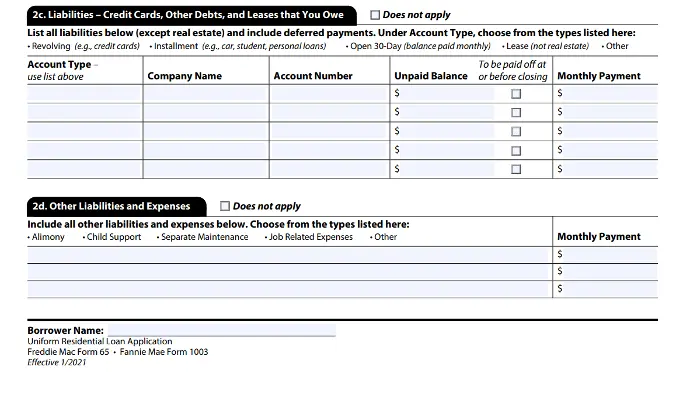

2c and 2d

Think of Section 2c on the loan application as a spot where you list all the stuff you're currently paying off, like credit card bills, your car loan, or your student loans. It's like a rundown of your monthly bills that don't include your house payments. You've got to tell the bank how much you owe, how much you pay every month, and whether you're going to clear any of those debts soon, like before you get this new loan.

Now, Section 2d is like the "other" category—anything that didn't fit in the list above. If you're paying for things like child support or maybe you have a side deal where you owe some payments, that's where you jot it down. It's all about giving the bank the full picture of your money situation. They need to see this to figure out if you can handle taking on a new loan without stretching yourself too thin.

Section 2c of the Uniform Residential Loan Application (URLA) pertains to the borrower's liabilities. This section is designed to capture information about the borrower's debts and recurring financial obligations, which are crucial for the lender to evaluate the borrower's debt-to-income ratio and overall creditworthiness. Borrowers are required to list out all liabilities, except those secured by real estate, and include details such as the type of account (e.g., revolving credit like credit cards, installment loans like car or student loans, open 30-day accounts, leases that are not for real estate, and other liabilities), the company name, account number, unpaid balance, monthly payment, and whether the debt will be paid off at or before closing.

Section 2d, on the other hand, is reserved for documenting other liabilities and expenses that may not fit into the categories listed in Section 2c. While the specific content of Section 2d is not detailed in the provided context, typically, this section would include any additional financial obligations or liabilities that the borrower has, which could impact their ability to repay the loan. This may involve alimony, child support, separate maintenance payments, or any other significant expenses that are not already captured in the previous sections.

Both Section 2c and Section 2d are integral to the lender's assessment of the borrower's financial health. They provide a full picture of the borrower's existing financial responsibilities, which, in conjunction with the assets declared in Sections 2a and 2b, help the lender determine the borrower's capacity to manage additional debt and make regular loan payments.