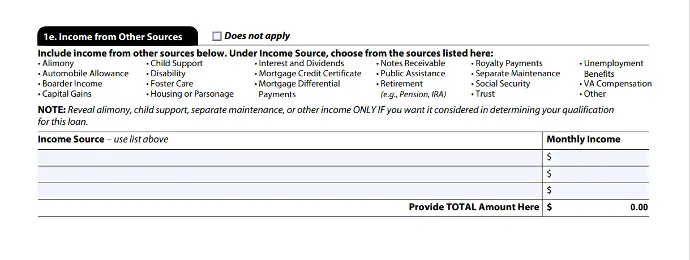

Section 1 of the 1003

Here is a visual of section 1 for reference.

This is you on a plate so to speak. Be transparent and complete. It will help speed your mortgage processing up dramatically.

- In Section 1: Borrower Information, you'll find personal information fields. If you are the only borrower applying for the mortgage loan, select "I am applying for Individual" under 1a. If there are multiple borrowers, select "I am applying for Joint Credit." Enter your initials if there are multiple borrowers, and provide the total number of borrowers completing the application. If you are known by other names list them under alternate names.

- Fill in the borrower's personal information, such as name, date of birth, and contact information. For address the lender needs 2 full years of address history - Providing this at the time of the loan application will speed up the process...If the street address includes a unit number, enter it in the "Unit #" field. You may also enter the country or province for non-United States addresses.

- Enter the monthly amount you are obligated to pay for your housing. Choose "No Primary Housing Expense" if you are not obligated to pay rent or if you do not own the home where you live. Select "Own" if you own the home where you live even if you have mortgage liens or home equity loans on the property.

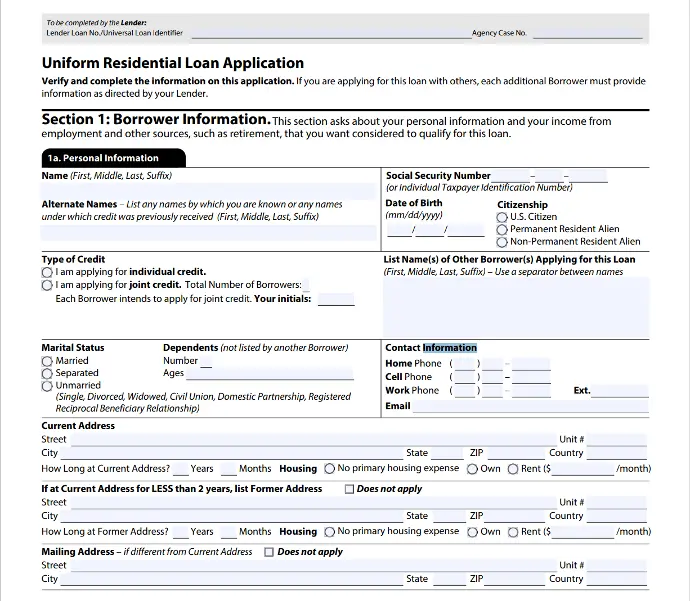

1b. Current Employment/Self-Employment and Income

Here is a visual for section 1b

- In Section 1b: Current Employment/Self-Employment and Income, provide information about your current employment or self-employment. Enter the name of your employer or business, or your name if you're self-employed.

- Select the Does not Apply box if you only receive non-wage income such as retirement or social security. These income types will be added to section 1e.

- Add your Position or Title to the blank as applicable.

- "Check if this statement applies." is to help determine a close personal relationship between the buyer and the seller or anyone else deemed to be a party to the transaction - anyone who will benefit from the sale is a PARTY to the Transaction. The buyer, seller, lender, builder, real estate agent, title company all benefit by getting something out of the transaction. if this is the case check the box and know that you will be under extra eyes and have some reasonable hurdles to help the lender feel confident that everything is on the up and up. This disclosure helps the lender identify any relationships that may require additional scrutiny to ensure that the loan is being made based on fair and unbiased terms and that there is no undue influence or conflict of interest that could affect the integrity of the loan process.

- If you are self-employed check the box to indicate so. Also - check the "I Have" box that applies to your situation. If you check "I have an Ownership share of 25% or more" you will be asked to provide business tax returns in addition to personal tax returns.

- if you are employed by someone*****Enter the main phone number of your employer***** this will be used to verify your employment, this will be done multiple times during the process. This will be done at the end of the process, possibly while you are signing closing paperwork. It's important that the lender can verify when needed that you are gainfully employed at the end of the process as well as during. Don't make any employment changes if at all possible. if something does happen - say something right away so your lender can help you

- Fill in the gross monthly income section, including military entitlements and other income not specified in the line items. Do your best on the figures you provide; they will be verified during the loan process so accuracy here is good but it's not going to be the number that the underwriter uses to make the loan decision.

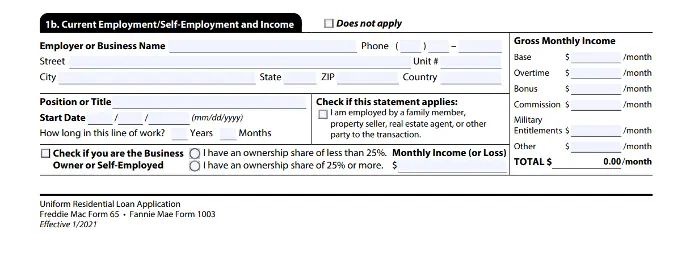

1c and 1d

1c is for Additional Employment/Self Employment

1d is for Previous Employment/Self Employment

fill out as needed

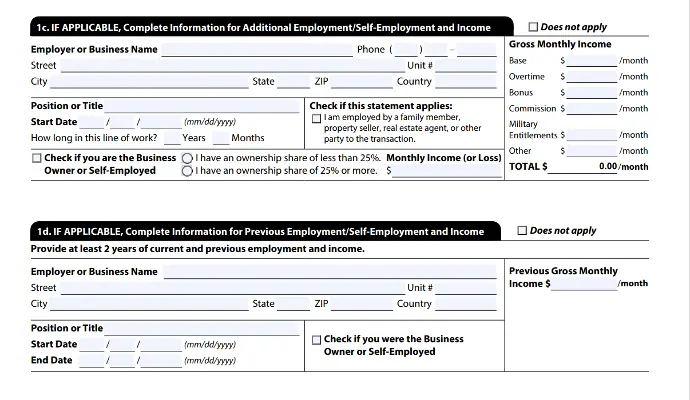

1e. Income from Other Sources